What Moved The Markets This Week 📈

U.S. Job Growth Overstated By 30%, AMD Acquires ZT Systems For $4.9B, Tesla Secures A Lower Tariff Rate In EU, Perplexity AI To Display Ads On Search Results, and SNOW + PANW + ZM Earnings

Sunday Morning Markets

Trading Week 34, covering Monday, Aug 19 through Friday, Aug 23. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

U.S. payrolls overstated by 800K jobs

S&P Composite PMI dips slightly to 54.1%

Tesla secures lower tariff rate in the EU

Walmart dumps its $4 billion stake in JD.com

Perplexity AI to start displaying ads on search results

AMD acquires ZT Systems for $4.9 billion

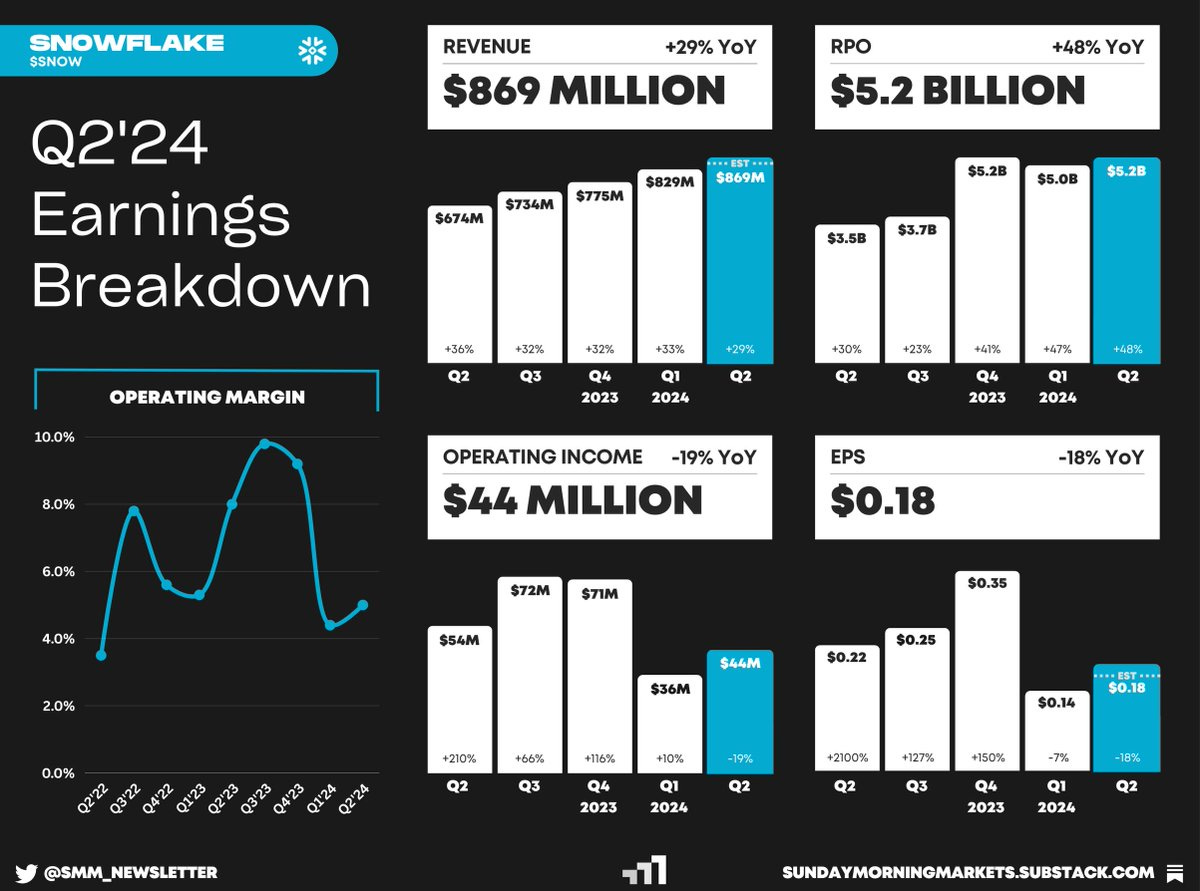

Earnings from Snowflake, Palo Alto Networks, Zoom

US Markets 🇺🇸

Fed minutes signal a likely rate cut in September as a “vast majority” of the committee believes it would be “appropriate to ease policy.” The market is now pricing in over four rate cuts this year.

Payroll growth was overestimated by 818,000 jobs marking the largest downward revision since 2009. The updated figures show job growth was 30% lower than previously reported. Yields fell following the news.

U.S. economic growth cools slightly in August with the S&P Composite PMI dipping to 54.1. Despite the minor slowdown, the U.S. economy remains strong amid high borrowing costs.

U.S. home sales ticked up 1.3% in July, ending a 4-month decline, but prices remained at record highs. Despite a slight dip in mortgage rates, the housing market stays sluggish with affordability still a major concern.

GM cuts 1,000+ software jobs globally to streamline operations. The layoffs come amid fears of an industry downturn, while the company spends billions on EVs and so-called software-defined vehicles.

Ford cancels plans for an electric three-row SUV and delays its new EV plant as it shifts focus to hybrid models and commercial EVs. The strategy aims to build a more capital-efficient, profitable EV business.

Global Markets 🌏

Tesla secures lower EU tariffs on China-made EVs, with duties reduced from 20.8% to 9%. The adjustment gives Tesla an advantage over competitors facing the higher duty rates.

Walmart dumps its $3.74 billion stake in JD.com to focus on its own China operations. The move allows Walmart to concentrate on its successful Sam's Club and digital growth in China.

Shein sues Temu for copyright infringement, claiming its rival steals designs and loses money on every sale. The suit alleges Temu relies on counterfeiting and IP theft to compete in the fast-fashion market.

Canada's inflation drops to a 40-month low of 2.5% in July, in-line with forecasts. Easing core inflation strengthens expectations for another Bank of Canada rate cut in September.

UK economic growth accelerates in August, with the S&P Composite PMI rising to 53.4, driven by strong jobs growth. This bolsters the government's agenda, with easing inflation possibly leading to further rate cuts.

Japan slips back into trade deficit with a $4.28 billion shortfall in July as rising import costs outpaced exports. A stronger yen further clouds the export outlook, challenging Japan’s economic recovery.

Tech ⚡

Startup failures surge 60% over the last year as cash dwindles from the 2021-22 tech boom, threatening millions of jobs. Despite a funding frenzy in AI, many firms face shutdowns, marking a sharp industry downturn.

Perplexity AI to launch ads amid surging popularity of its AI-assisted search app, now with 230 million monthly users. The move follows controversy over plagiarism, as the company eyes new revenue streams.

AMD to acquire ZT Systems for $4.9 billion to enhance its AI hardware capabilities and compete with Nvidia. AMD plans to sell ZT’s server manufacturing business after the acquisition closes in 2025.

Waymo redesigns its robotaxi to offer more space with fewer sensors, cutting costs without sacrificing performance. The sixth-gen system enhances comfort and weather handling in Geely Zeekr EVs.

OpenAI signs content deal with Condé Nast to feature articles from Vogue, The New Yorker, and Wired in its AI tools. This move deepens the integration of premium media into ChatGPT and SearchGPT.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Durable Goods 🇺🇸

DE - Ifo Business Climate 🇩🇪

Earnings: PinDuoDuo💰

Tuesday

US - CB Consumer Confidence 🇺🇸

AU - CPI Inflation 🇦🇺

Earnings: SentinelOne, Box💰

Wednesday

DE - GfK Consumer Confidence 🇩🇪

Earnings: Nvidia, Salesforce, CrowdStrike, Chewy, Veeva, Okta, Affirm💰

Thursday

US - Jobless Claims 🇺🇸

US - GDP Growth 🇺🇸

US - Pending Home Sales 🇺🇸

DE - CPI Inflation 🇩🇪

EU - Economic Sentiment 🇪🇺

JP - Retail Sales 🇯🇵

Earnings: Lululemon, MongoDB, Dell, Marvell, Autodesk, Ulta💰

Friday

US - PCE Inflation 🇺🇸

US - Personal Income & Spending 🇺🇸

US - Chicago PMI 🇺🇸

CA - GDP Growth 🇨🇦

EU - CPI Inflation 🇪🇺

CN - NBS Manufacturing PMI 🇨🇳

Want to partner with Sunday Morning Markets? Click here to inquire.