What Moved The Markets This Week

Donald Trump Wins U.S. Presidency, Bitcoin Soars to New Highs, Fed Cuts Rates, Buffett’s Cash Pile Hits $325B, and Earnings from Airbnb, Palantir, and Square

Sunday Morning Markets

Trading Week 45, covering Monday, Nov 4 through Friday, Nov 8. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Donald Trump elected as 47th U.S. President

Fed cuts interest rates by quarter point

Buffett continues to sell equities, cash pile hits $325B

China rolls out new $1.4T stimulus package

Bitcoin surges to new high

Audi unveils new EV brand

Perplexity triples valuation to $9B

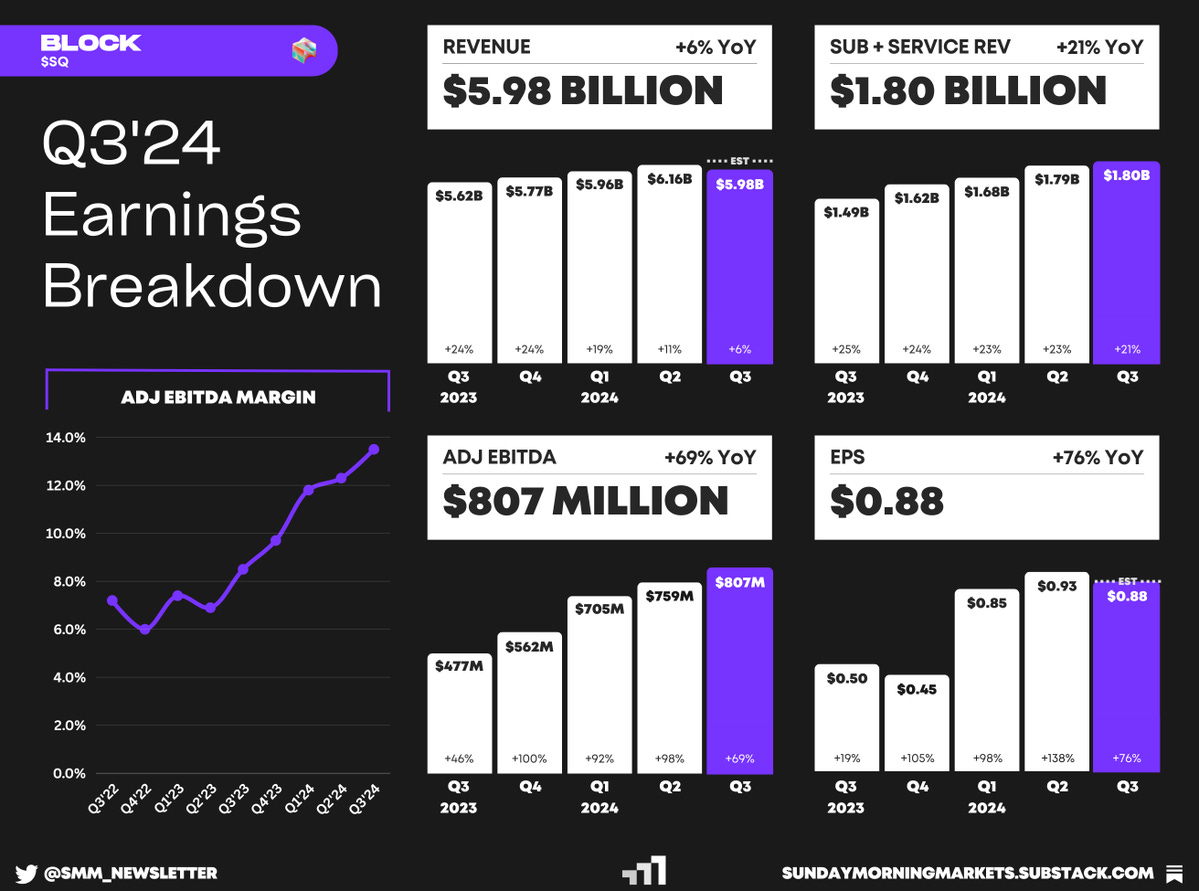

Earnings from Palantir, Airbnb, Block

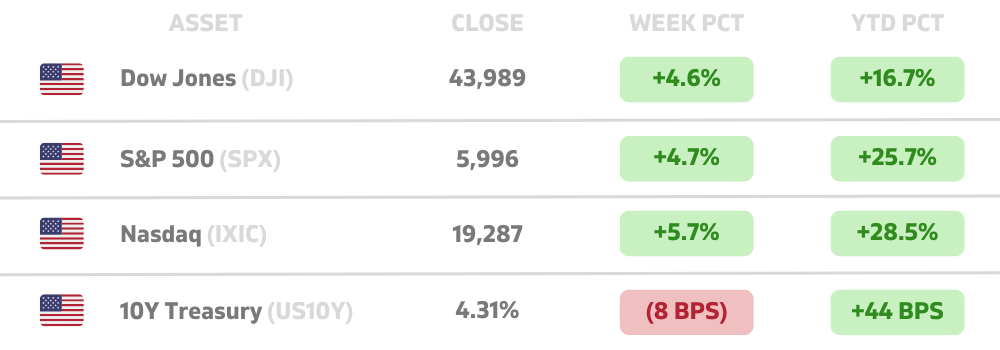

US Markets 🇺🇸

Donald Trump elected as 47th U.S. president in a historic comeback, defeating Kamala Harris. This unprecedented win returns Trump to the White House, reshaping America’s political landscape.

Fed cuts interest rates by a quarter point but signaled a little more uncertainty over how quickly it would continue lowering rates. Powell reaffirmed his commitment to his term despite election pressures.

U.S. services PMI hits two-year high as October’s employment rebound drives economic momentum. The trade deficit widened with record imports, while inflation concerns eased amid steady commodity prices.

Berkshire’s cash hits record $325B as Buffett sells off Apple and Bank of America shares. With no major acquisitions since 2016, analysts wonder if he’s prepping for an economic downturn or a big buy.

Boeing strike ends as workers accept new contract with a 38% pay rise over four years. The deal follows a costly seven-week halt in production and challenges its new CEO to repair relations with its workforce.

Global Markets 🌏

China launches $1.4 trillion plan to curb local debt, a five-year effort aimed at reducing “hidden” liabilities while boosting economic support. More fiscal measures are expected in 2025.

Bank of England cuts rates but warns of caution ahead due to inflationary pressures from Labour’s fiscal policies. Rates drop to 4.75% with future cuts expected to be gradual.

RBA keeps rates steady at 4.35%, signaling a cautious approach amid high inflation and strong job growth. The RBA lags other central banks on rate cuts and even left future hikes on the table.

China's exports surge to 19-month high, rising 12.7% in October, as its services PMI jumps to 52.0. The reports suggest Beijing’s stimulus is lifting growth, though experts call for further fiscal support.

Tesla’s China-made EV sales dropped 5.3% in October to 68,280 units, while rival BYD soared 66.2% with 500,526 vehicles sold. Tesla extended zero-interest financing to boost demand.

Tech ⚡

Bitcoin surges to a new high of $77K as Trump’s election victory energizes crypto markets. His promises of crypto-friendly policies and reduced regulations fuel market optimism.

Perplexity AI triples valuation to $9B with new funding round led by Institutional Venture Partners. This strengthens its position as a leading AI startup, facing fierce competition with OpenAI and Google.

Trump expected to shift course on antitrust, likely halting Google breakup efforts and relaxing merger rules. The shift in policy paves the way for increased M&A activity, opening up VC markets.

Audi launches new EV brand in China without iconic logo, aiming to attract younger consumers. Partnering with SAIC, Audi enters China’s fast-growing EV market with tech-forward designs.

TSMC halts production of advanced AI chips for China, following U.S. export restrictions aimed at curbing Chinese AI capabilities. Future shipments to Chinese firms now face stringent approvals.

OpenAI hires Meta’s former AR head, Caitlin Kalinowski, to lead its robotics and hardware initiatives. Her role will focus on integrating AI into physical products, signaling OpenAI’s push into consumer robotics.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

AU - NAB Business Confidence 🇦🇺

Earnings: Monday, Grab💰

Tuesday

US - NY Fed Inflation Expectations 🇺🇸

UK - Employment Report 🇬🇧

EU - Economic Sentiment 🇪🇺

DE - CPI Inflation 🇩🇪

Earnings: Shopify, Spotify, Cava, Sea Ltd, Home Depot, On Running, Plug Power💰

Wednesday

US - CPI Inflation 🇺🇸

AU - Employment Report 🇦🇺

Earnings: Cisco, CyberArk, Hut8, DLocal💰

Thursday

US - Jobless Claims 🇺🇸

US - PPI Inflation 🇺🇸

UK - GDP Growth 🇬🇧

EU - GDP Growth 🇪🇺

JP - GDP Growth 🇯🇵

CN - Industrial Production 🇨🇳

Earnings: Disney, Applied Materials, JD, Oklo💰

Friday

US - Retail Sales 🇺🇸

Earnings: Alibaba💰

Want to partner with Sunday Morning Markets? Click here to inquire.