What Moved The Markets This Week 📈

DOJ Sues Ticketmaster, Neuralink Gets Green Light For 2nd Patient, Hims Unveils GLP-1, SEC Approves Ethereum ETFs, Tesla Cuts Model Y Production, and NVDA + SNOW + PANW Earnings

Sunday Morning Markets

Trading Week 21, covering Monday, May 20 through Friday, May 24. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

US Markets 🇺🇸

PMIs show economic growth accelerating

DOJ sues to breakup Live Nation, Ticketmaster

Hims launches compound GLP-1 for $199/mo

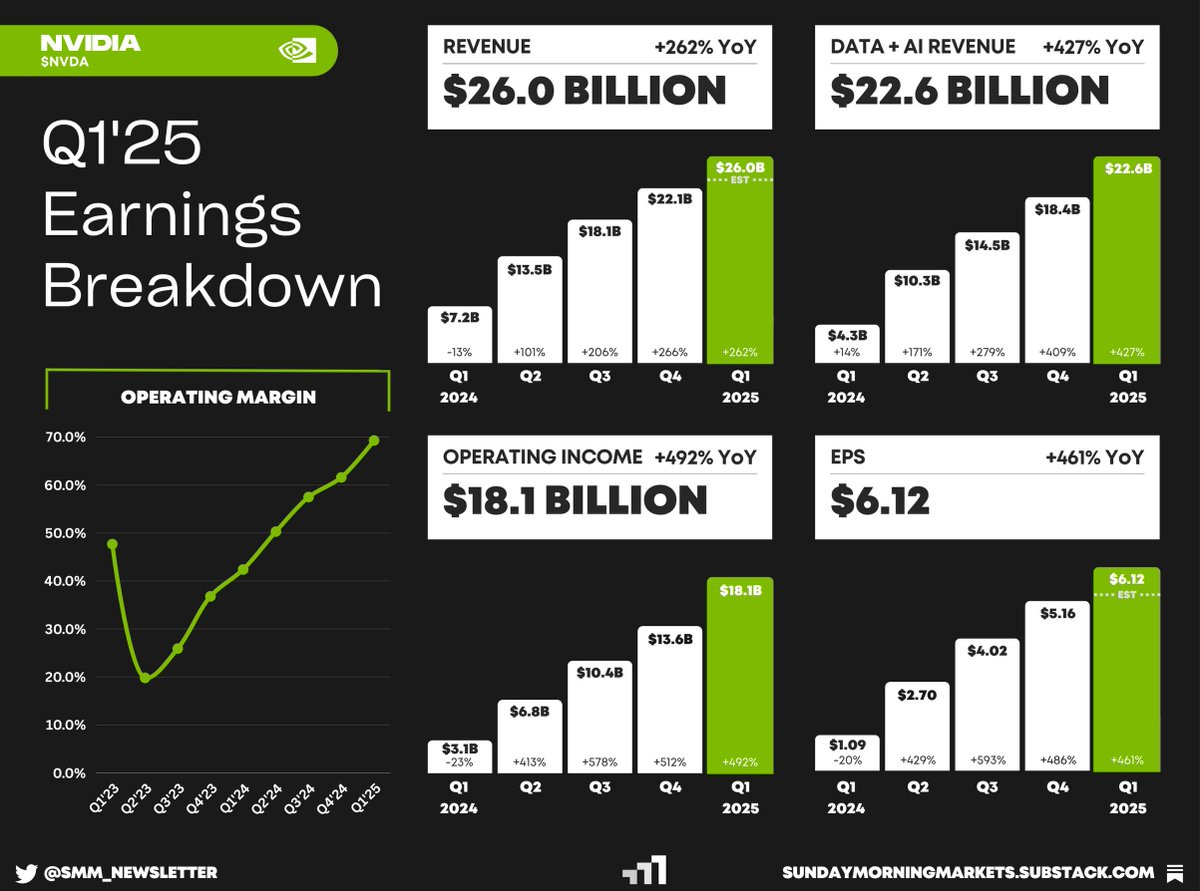

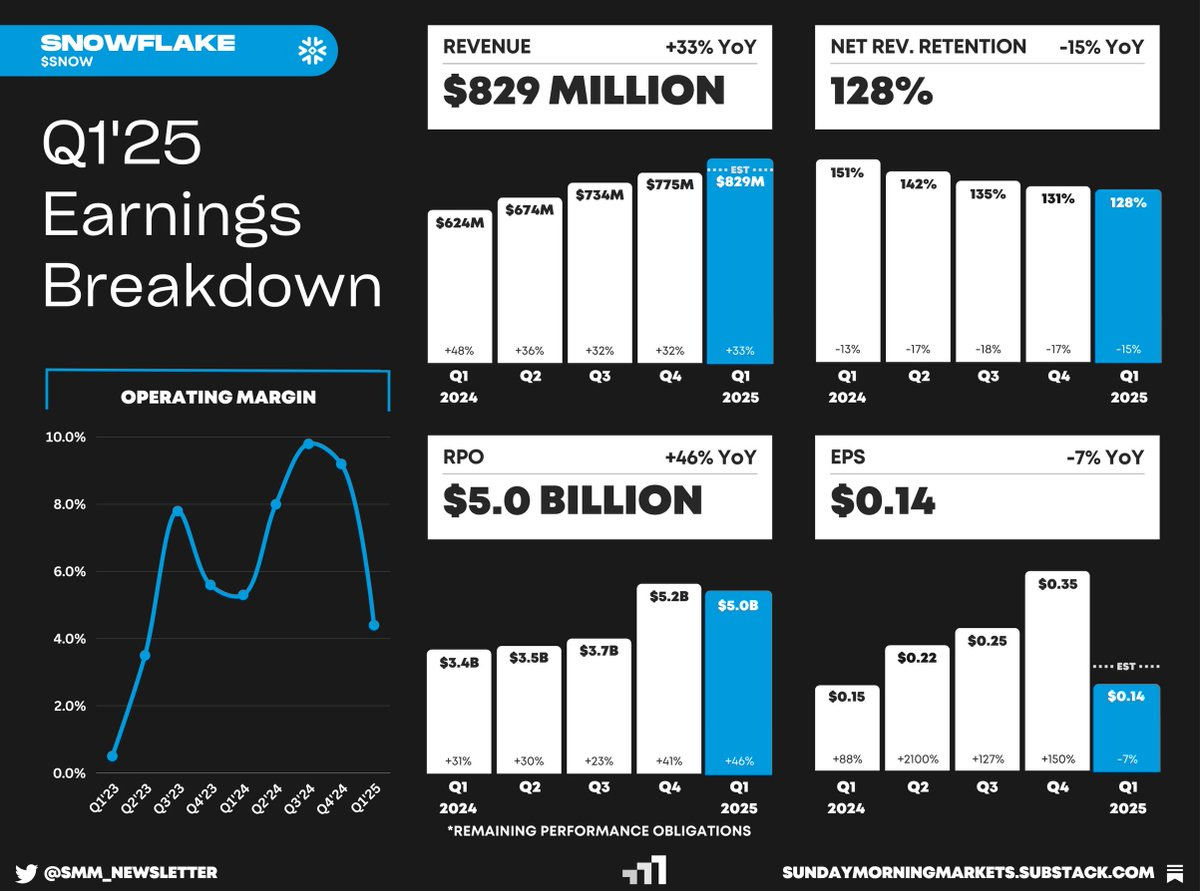

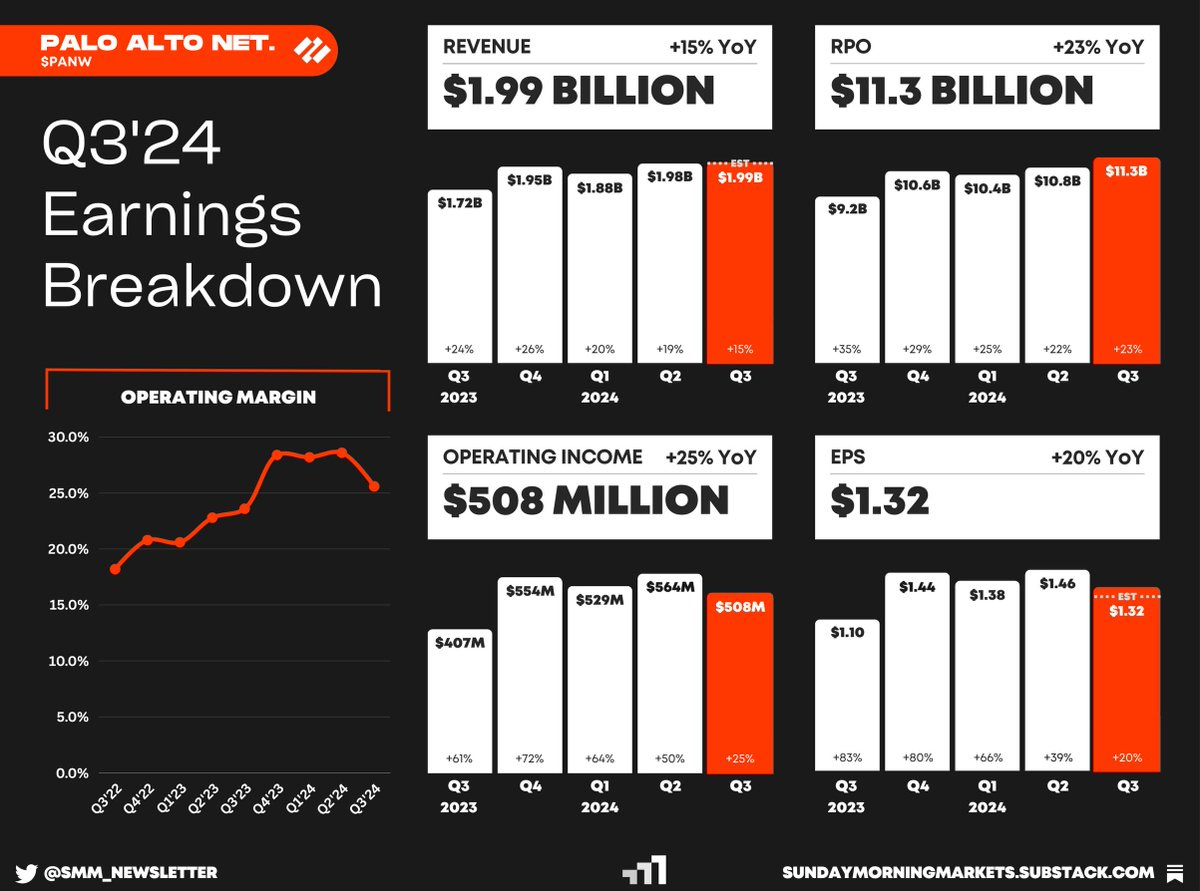

Earnings from Nvidia, Snowflake, and Palo Alto Networks

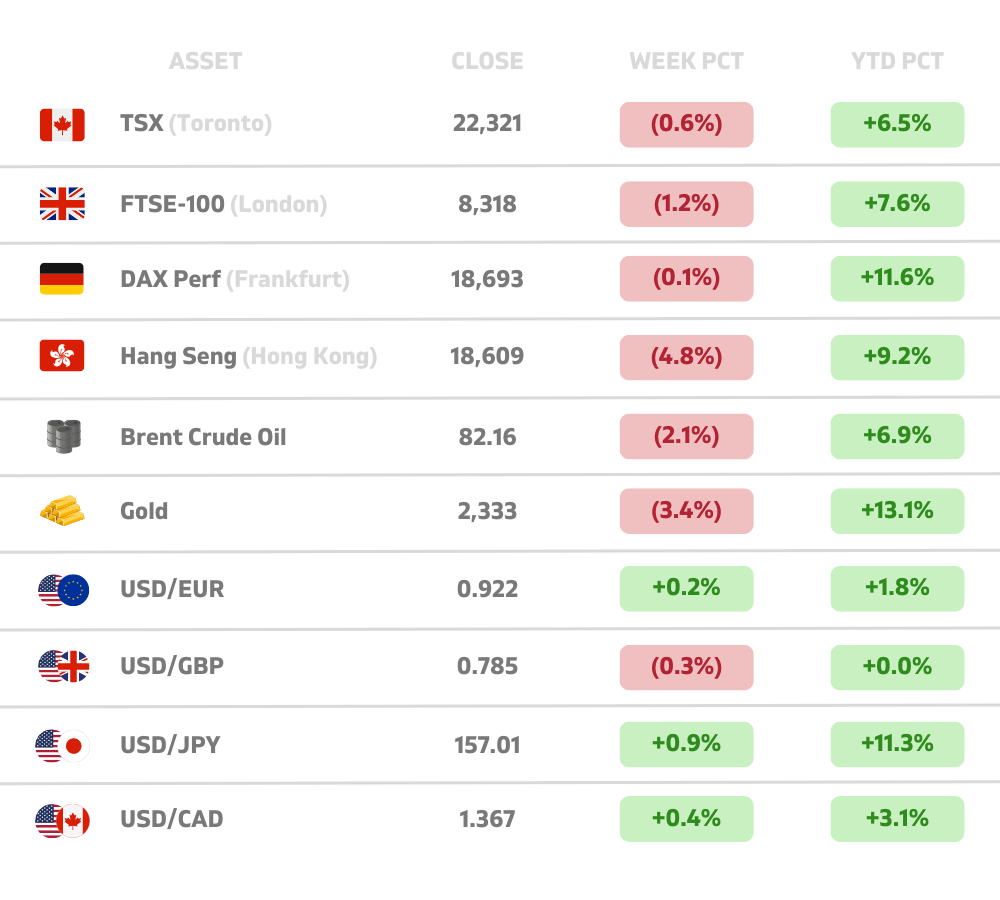

Global Markets 🌏

Tesla slashes Model Y production in Shanghai plant

Alibaba to raise nearly $5B to buyback shares

Iran’s president dies in helicopter crash

Tech ⚡

Neuralink gets green light for 2nd patient

SEC approves rule change for Ethereum ETFs

Amazon overhauls Alexa with AI features

US Markets 🇺🇸

US business activity accelerated in May, but manufacturers reported a surge in prices for a range of inputs. S&P’s Composite PMI jumped to 54.4, the highest level in nearly two years.

Home sales unexpectedly fell again in April as mortgage rates remained elevated. Supply of homes for sale rose 16% from the year before while the median selling price rose 5.7% to $407,600.

The DOJ sues to split up Live Nation and Ticketmaster over antitrust violations, claiming they ‘suffocate competitors.’ The company controls roughly 80% of major concert venues’ primary ticketing systems.

Capital goods orders improve more than expected, suggesting a recovery in business investments. Inflation expectations also improved with the one-year outlook falling to 3.3% from 3.5%.

Biden forgives another $7.7 billion of student debt for more than 160,000 borrowers. With this latest round of relief, Biden has forgiven over $167 billion of student loans for 4.75 million borrowers.

Lululemon’s Chief Product Officer resigns to pursue another opportunity as the company restructures its product and brand teams. The apparel company says it will not refill the CPO role.

Hims debuts $199 weight-loss shots with the same active ingredient as GLP-1s like Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound, but sold at an 85% discount. HIMS 0.00%↑ shares surged 16% this week.

Global Markets 🌏

Business activity in the Eurozone accelerates in May as the S&P Composite PMI rose for the third straight month to 52.3. The uptick was led by Germany, where its strength in services led its own PMI to a 1-year high.

Shipping container rates soared by 30% in the past weeks as 90% of ships diverted from the Red Sea to avoid Houthi attacks. Instead, ships go around the Cape of Good Hope in South Africa, adding 2.5 weeks of traveling time.

Iran’s President, Ebrahim Raisi, dies in helicopter crash while returning from Azerbaijan in poor weather conditions. Iran’s foreign minister, Hossein Amirabdollahian, also died in the accident.

Nvidia cuts prices in China in chip fight with Huawei as inventory continues to pile up. This comes after Beijing advised firms to buy Chinese chips. China represented 17% of Nvidia’s total revenue last year.

Tesla slashes Model Y production in Shanghai by double-digits amid weakening demand. In total, Tesla produced 287K units of Model Y & Model 3 in China so far this year, 5% lower than the same period in 2023.

Alibaba to raise $4.5 billion with bonds to fund stock buybacks, following a similar move by rival e-commerce giant, JD. The convertible senior notes maturing in seven years will carry a coupon of 0.5%.

Swedish EV maker, Polestar, gets Nasdaq delisting notice and will have 60 days to submit a compliance plan. The company is also working to file its annual report for 2023 and first-quarter results for 2024.

Tech ⚡

Neuralink receives green light for 2nd patient from the FDA after proposing fixes for a problem that occurred in the first test participant. These fixes include embedding some of the ultrathin wires deeper in the brain.

Microsoft unveils new PCs with advanced chips from Qualcomm in order to run artificial intelligence features without quickly using up their battery life. These Copilot+ PCs will start at $999.

SEC approves rule change to allow creation of Ether ETFs less than six months after approving Bitcoin ETFs. Ether ETFs are expected to be smaller, at least initially, than their bitcoin counterparts.

Amazon to launch new AI-powered Alexa and will likely charge a subscription to offset the cost of the technology. The subscription will not be a part of its Amazon Prime offering.

Amazon and Meta back Scale AI in $1 billion funding round that values the startup at $14B, nearly double its last reported valuation. Accel led the round, with additional investments from Nvidia, AMD, Cisco, Intel, and ServiceNow.

ChatGPT’s mobile app revenue saw its biggest spike yet following GPT-4o launch. The app saw a 22% increase in revenue on the day of the release and continued to grow in the following days, according to Appfigures.

Musk's SpaceX may sell shares at $200B valuation to allow employees and investors access to liquidity. The tender offer represents a premium to its last valuation of $180B and is expected to kick off in June.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Markets Closed (Memorial Day) 🇺🇸

UK - Markets Closed (Bank Holiday) 🇬🇧

CA - Wholesale Sales 🇨🇦

DE - Ifo Business Climate 🇩🇪

Tuesday

US - CB Consumer Confidence 🇺🇸

JP - CPI Inflation 🇯🇵

Earnings: Cava, Box💰

Wednesday

US - Beige Book 🇺🇸

DE - CPI Inflation 🇩🇪

DE - Consumer Climate 🇩🇪

Earnings: Salesforce, Okta, Chewy, C3.ai, UiPath💰

Thursday

US - GDP Growth 🇺🇸

US - Jobless Claims 🇺🇸

US - Pending Home Sales 🇺🇸

EU - Unemployment Report 🇪🇺

CN - Composite PMI 🇨🇳

Earnings: Costco, ZScaler, Dell, Marvell, MongoDB, SentinelOne, Veeva, Net App, Elastic 💰

Friday

US - PCE Inflation 🇺🇸

US - Personal Spending 🇺🇸

US - Chicago PMI 🇺🇸

CA - GDP Growth 🇨🇦

EU - CPI Inflation 🇪🇺

DE - Retail Sales 🇩🇪

Want to partner with Sunday Morning Markets? Click here to inquire.