What Moved The Markets This Week 📈

Fed Holds Interest Rates Steady, Payrolls Surge 353K, Amazon Scraps iRobot Acquisition, FanDuel Goes Public Under $FLUT, and AMZN + AAPL + MSFT + META Earnings

Sunday Morning Markets

Trading Week 5, covering Monday, Jan 29 through Friday, Feb 2. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Labor Market Data:

Nonfarm Payrolls +353K (est. 185K) 🔥

Job Openings 9.03M (est. 8.75M) 🔥

Unemployment Rate 3.7% (est. 3.8%) 🔥

Avg. Hourly Earnings +4.5% (est. 4.1%) 🔥

Layoffs from UPS, PayPal, Block and Okta

Fed & BoE both hold interest rates steady

Amazon scraps acquisition of iRobot

Musk’s $56 billion compensation package voided

FanDuel-parent goes public under ticker FLUT

Spotify re-signs Joe Rogan to $250 million deal

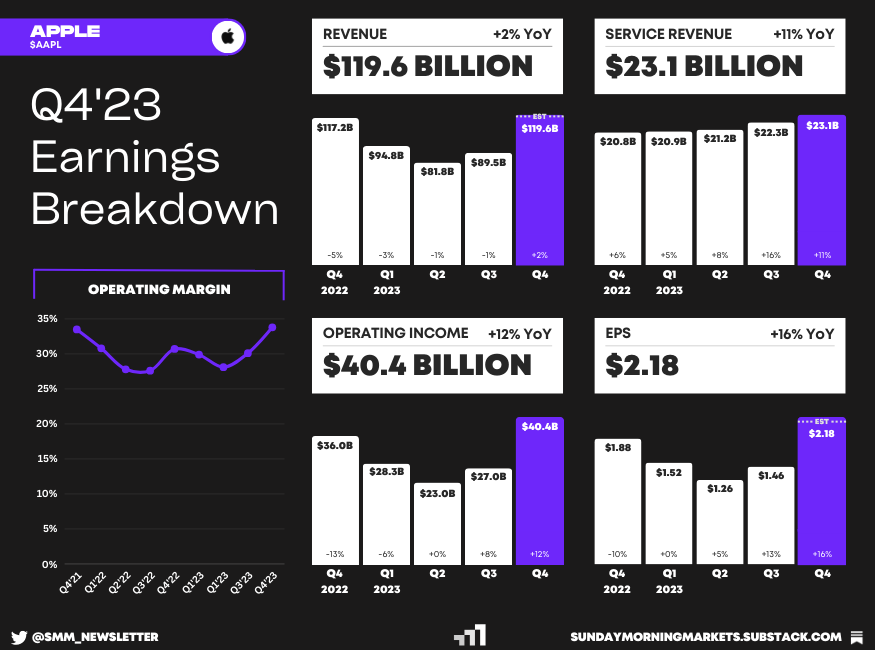

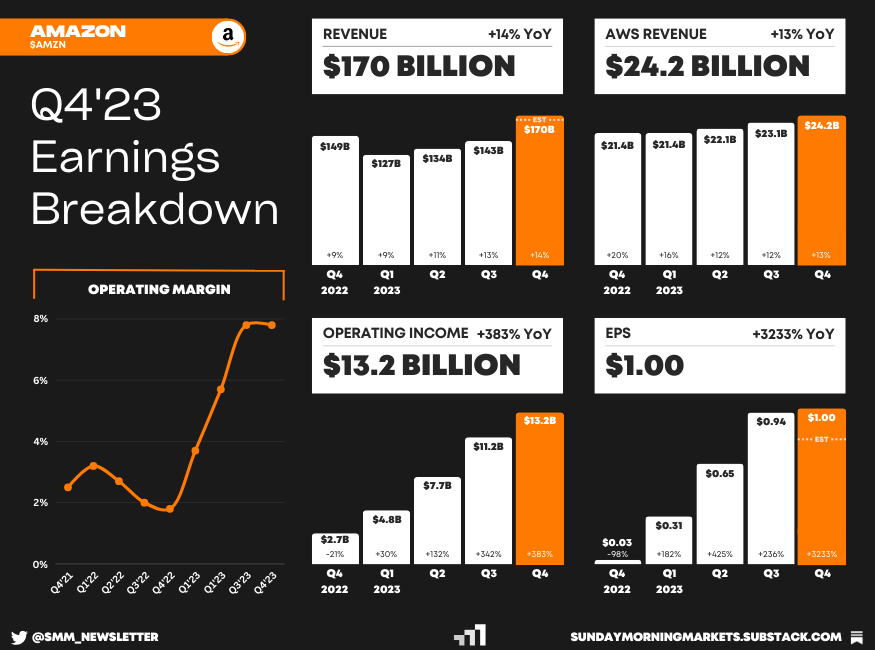

Earnings from Microsoft, Amazon, Apple and Meta

US Markets 🇺🇸

Fed holds interest rates steady again and signals that a March rate cut is unlikely as inflation remains above target. According to CME’s FedWatch tool, the market still expects roughly six rate cuts by the end of 2024.

Job openings unexpectedly rise to a three-month high of 9.03 million, well above the consensus estimate of 8.75 million. At the same time, voluntary quits fell to 3.4 million, the lowest level in nearly three years.

Nonfarm payrolls surged 353,000 in January, much stronger than expected (185,000). Average hourly earnings increased 0.6%, double the monthly estimate, as the labor market remains hot despite corporate layoffs.

Amazon terminates its acquisition of iRobot and says there was “no path” to regulatory approval. Following the news, iRobot’s CEO stepped down and the company laid off 35% of staff, causing its shares to plummet over 20%.

Musk aims to incorporate Tesla in the state of Texas rather than Delaware after a judge voided his $56 billion compensation package that was granted to him in 2018. Musk can appeal the decision to the Delaware Supreme Court.

Walmart plans to build 150 new large-format stores across the U.S. over the next five years. The company already has more than 4,600 stores across the country, and nearly 600 Sam’s Club warehouses.

UPS to cut 12,000 jobs as package volume slips both internationally and domestically. The company expects to save about $1 billion from the workforce reduction and sees revenue growing a modest 2.5% this year.

PayPal to reduce its workforce by 9% as part of a larger turnaround plan. “We are doing this to right-size our business, allowing us to move with the speed needed to deliver for our customers and drive profitable growth,” the CEO said.

Global Markets 🌏

IMF raises its global growth forecast to 3.1%, citing the unexpected strength of the U.S. economy and fiscal support measures in China. The IMF did note elevated risks to commodities and supply chains from Middle East volatility.

Eurozone narrowly avoided a recession in Q4 as growth in Italy and Spain offset the weakness in Germany. GDP in the EU stagnated as elevated interest rates and flimsy foreign demand continued to weigh.

Eurozone inflation eases to 2.8% in January, in line with estimates and down slightly from December’s reading of 2.9%. Core inflation dipped to 3.3% but came in hotter than expected.

Bank of England holds rates at 5.25% and signals that cuts are likely later this year. “We need to see more evidence that inflation is set to fall all the way to the 2% target, and stay there, before we can lower interest rates.”

China’s manufacturing activity shrank again for the fourth straight month in January as the official manufacturing PMI rose slightly to 49.2. China’s services economy showed growth with the non-manufacturing PMI rising to 50.7.

EU agrees to a €50 billion aid package for Ukraine and says that funds from Budapest would be excluded from the deal. Ukraine’s army chief, Valeriy Zaluzhnyi, is expected to be dismissed from his post in the coming days.

Hungary accuses EU of blackmail over Ukraine aid after a leaked document reportedly suggested that the bloc plans to sabotage Budapest’s economy if it vetoes the fresh 50 billion Euros of aid for Ukraine.

U.S. launches series of airstrikes in Syria and Iraq, hitting more than 85 targets and escalating the conflict with Iran. The U.S. aims to deter further attacks after American troops were killed in a drone strike in Jordan.

Tech ⚡

FanDuel parent goes public under ticker FLUT, offering investors an alternative to the sports betting giant, DraftKings. FanDuel is the largest online sportsbook in the U.S. with a 51% market share.

Instagram Threads triples downloads in December after growth stalled last year. During the month, Threads earned the No. 4 spot in the App Store with 12 million downloads, and the No. 8 spot in Google Play with 16 million downloads.

First human to receive Neuralink brain implant is 'recovering well,' Elon Musk says. Neuralink's brain-computer interface, or BCI, would allow people to control a computer or mobile device wirelessly just by thinking about it.

Joe Rogan gets new Spotify deal worth $250 million with an upfront guarantee and a revenue-sharing agreement. The new deal will allow his hit show to be distributed broadly, rather than exclusively on Spotify.

FTX expects to fully repay all customers but ends its plans to restart a new crypto exchange. FTX's native token, FTT, plummeted over 30% following the news of the company’s plans.

Meta to deploy in-house custom chips this year aimed at supporting its AI push. The chip will help to reduce their dependence on Nvidia. Meta plans to put the updated chip into production in 2024.

SpaceX signs major deal with Starlab for 2028 launch as NASA prepares to retire the International Space Station in 2030. Starlab’s space station is being built by Voyager Space and Airbus in a joint venture.

Earnings Reports 💰

See Google and other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - ISM Non-Manufacturing PMI (JAN)🇺🇸

US - S&P Services PMI (JAN)🇺🇸

EU - HCOB Composite PMI (JAN)🇪🇺

AU - RBA Interest Rate Decision🇦🇺

Earnings Reports: McDonald’s, Caterpillar, Palantir, On Semi, Estee Lauder💰

Tuesday

CA - Ivey PMI (JAN)🇨🇦

Earnings Reports: Eli Lilly, Toyota, Amgen, Fiserv, Chipotle, Ford, Spotify, Snap, Enphase, Fortinet💰

Wednesday

US - Atlanta Fed GDPNow (Q1)🇺🇸

US - Consumer Credit (DEC)🇺🇸

US - Trade Balance (DEC)🇺🇸

CN - CPI Inflation (JAN)🇨🇳

CN - PPI Inflation (JAN)🇨🇳

Earnings Reports: Alibaba, Disney, Uber, Arm, PayPal, Confluent💰

Thursday

US - Jobless Claims🇺🇸

EU - ECB Economic Bulletin🇪🇺

Earnings Reports: Cloudflare, Affirm, Pinterest, Bill, Expedia💰

Friday

CA - Unemployment (JAN)🇨🇦

DE - CPI Inflation (JAN)🇩🇪

Earnings Reports: Pepsi💰

Want to partner with Sunday Morning Markets? Click here to inquire.