What Moved The Markets This Week

Trump's Tariff "Liberation" Day, Unemployment Hits 4.2%, TikTok Ban Delayed, Circle Files for IPO, China Hits U.S. With 34% Tariff, and Amazon Debuts Nova AI Agent.

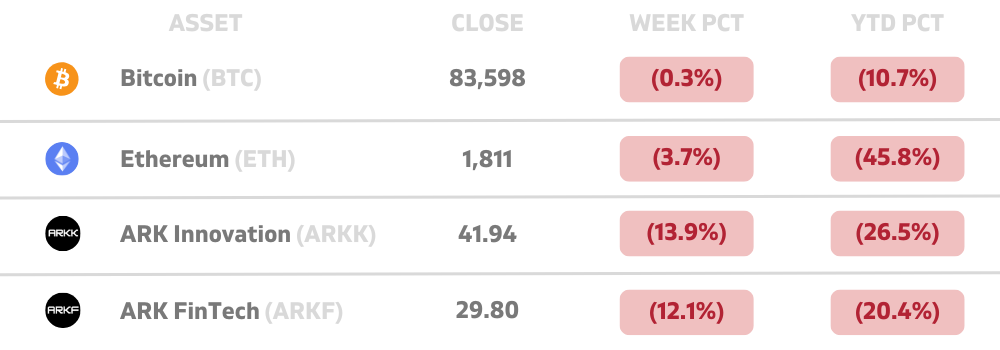

Sunday Morning Markets

Trading Week 14, covering Monday, Mar 31 through Friday, Apr 4. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Trump Tariffs: Trump unveils duties on 180+ nations, China hits 54%.

Jobs Beat: March adds 228K roles, but jobless rate ticks to 4.2%.

US Slowdown: Services growth stalls; manufacturing contracts again.

Recession Risk: Goldman ups odds to 35%, GDPNow sees Q1 contraction.

China Hits Back: Slaps 34% tariffs on all U.S. goods.

Oil Shock: OPEC+ triples output hike, crude prices dive 10%.

TikTok Delay: Trump extends ByteDance divestment deadline 75 days.

Amazon Nova: New AI agent automates browser tasks, rivals OpenAI.

OpenAI Funding: Raises $40B at $300B valuation for AI expansion.

Circle IPO: USDC issuer files to go public, eyes $5B valuation.

US Markets 🇺🇸

Trump targets 180+ countries with new tariffs unveiling “reciprocal” duties that match half of what others “charge” the US. China’s total rate now hits 54% under the sweeping policy shift.

Powell says Fed won’t cut rates yet amid tariffs and warns Trump’s sweeping levies could boost inflation and slow growth, leaving policy on hold until clearer data emerges.

March payrolls beat forecasts with 228K jobs added, signaling solid labor market momentum, even as unemployment rose to 4.2%. Trade tensions, tariffs, and layoffs spark concern over future economic stability.

US services growth slows sharply, manufacturing contracts as ISM Services PMI falls to 50.8 in March, missing estimates. The ISM Manufacturing PMI dipped to 49.0, signaling renewed industrial weakness.

Layoffs surge to 275K in March, highest since 2020 as Musk’s DOGE cuts 216K federal jobs. At the same time, US job openings dropped more than expected to 7.57 million.

Goldman Sachs doubles U.S. recession odds to 35% as tariffs and weak sentiment drive inflation higher and growth lower in 2025. Atlanta's Fed GDPNow tool predicts a 0.8% contraction in Q1.

Rocket Mortgage to acquire Mr Cooper for $9.4B in a major bet on housing's rebound. The deal adds 7M clients and boosts Rocket’s mortgage scale, just weeks after its Redfin purchase

Tesla deliveries plunge 13% as backlash grows with protests, boycotts, and political fallout weighing on sales. Shares sank 36% in Q1, marking its worst quarter since 2022. Rumors suggest Elon may exit his position at DOGE.

Global Markets 🌏

OPEC+ stuns markets with sharp output hike, bumping crude supply by 411,000 bpd in May—triple the expected pace. Oil prices plunged over 6% as traders reacted to the surprise move.

China retaliates with sweeping 34% tariffs on all U.S. imports starting April 10, escalating a trade war that’s rattling global markets and putting $582B in US-China trade at risk.

Eurozone inflation nears ECB’s 2% target, falling to 2.2% as service prices ease and unemployment hits a record low. Markets widely expect a rate cut at the upcoming ECB meeting on April 17.

RBA holds rates at 4.1%, flags global risks as U.S. tariffs and geopolitical tensions cloud outlook. Despite easing inflation, the central bank remains cautious and signals no rush to cut further.

China’s factory activity hits 1-year high in March with the PMI hitting 50.5 as stimulus fuels construction and services activity. However, looming tariffs and fading export strength threaten to stall the fragile recovery.

France's Marine Le Pen barred from office for 5 years after a conviction for using EU funds to pay party staff. A 2027 presidential front-runner, her removal shakes the far-right’s political future.

Canada’s services PMI sinks to near 5-year low as tariffs and election uncertainty hamper demand. March’s index fell to 41.2, the weakest since June 2020, with business confidence sharply eroding.

Tech ⚡

Amazon unveils Nova, an AI agent that controls your browser and performs tasks on a user’s behalf. The agentic tool puts Amazon in direct competition with rivals OpenAI and Anthropic.

USDC stablecoin issuer Circle files for IPO and targets a $4B to $5B valuation. USDC has $60B in circulation, making up 26% of the stablecoin market, and is second only to Tether, which holds a dominant 67% share.

Trump extends TikTok deadline by another 75 days as ByteDance seeks U.S. buyers and navigates regulatory hurdles. The extension delays a potential ban and keeps the app running through mid-June.

OpenAI raises $40B at $300B post-money valuation, marking one of the largest private rounds ever. Backed by SoftBank, funds will fuel AI research and its Stargate data center project.

Amazon resumes drone deliveries in Texas and Arizona after a two-month pause to fix altitude sensor issues. FAA-approved updates clear the way for Amazon’s push toward 500M annual drone deliveries by 2030.

Plaid raises $575M at $6.1B valuation but delays IPO plans as it tackles expiring RSUs and boosts employee liquidity. Despite a valuation drop, the fintech reports record revenue and surging enterprise demand.

Earnings Reports 💰

No major earnings this week. This section will be back next week.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Consumer Credit 🇺🇸

CA - BoC Business Outlook 🇨🇦

DE - Trade Balance 🇩🇪

Tuesday

CA - Ivey PMI 🇨🇦

Earnings: Walgreens💰

Wednesday

CN - CPI Inflation 🇨🇳

CN - PPI Inflation 🇨🇳

Earnings: Delta Airlines💰

Thursday

US - CPI Inflation 🇺🇸

US - Jobless Claims 🇺🇸

US - Federal Budget Balance 🇺🇸

UK - BOE Credit Conditions 🇬🇧

Earnings: CarMax💰

Friday

US - PPI Inflation 🇺🇸

UK - GDP Growth 🇬🇧

UK - Industrial Production 🇬🇧

CN - New Loans 🇨🇳

Earnings: JPMorgan, Wells Fargo, Morgan Stanley, BlackRock💰

Want to partner with Sunday Morning Markets? Click here to inquire.