What Moved The Markets This Week

Gensler Out As SEC Chair, Amazon Invests $4B Into Anthropic, ServiceTitan IPO, Spirit Airlines Goes Bankrupt, Japan Unveils Major Stimulus Plan, and Earnings From Nvidia, Snowflake, and Palo Alto

Sunday Morning Markets

Trading Week 47, covering Monday, Nov 18 through Friday, Nov 22. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Business activity hits 31-month high, PMI climbs to 55.3

Gary Gensler to resign as SEC Chairman

Amazon invests another $4B into Anthropic

ServiceTitan to IPO on Nasdaq under ticker “TTAN”

Microstrategy now holds 331,200 BTC worth $32.5B

Spirit Airlines files for bankruptcy protection

Moscow signals readiness for nuclear retaliation

Japan unveils new $141B stimulus plan

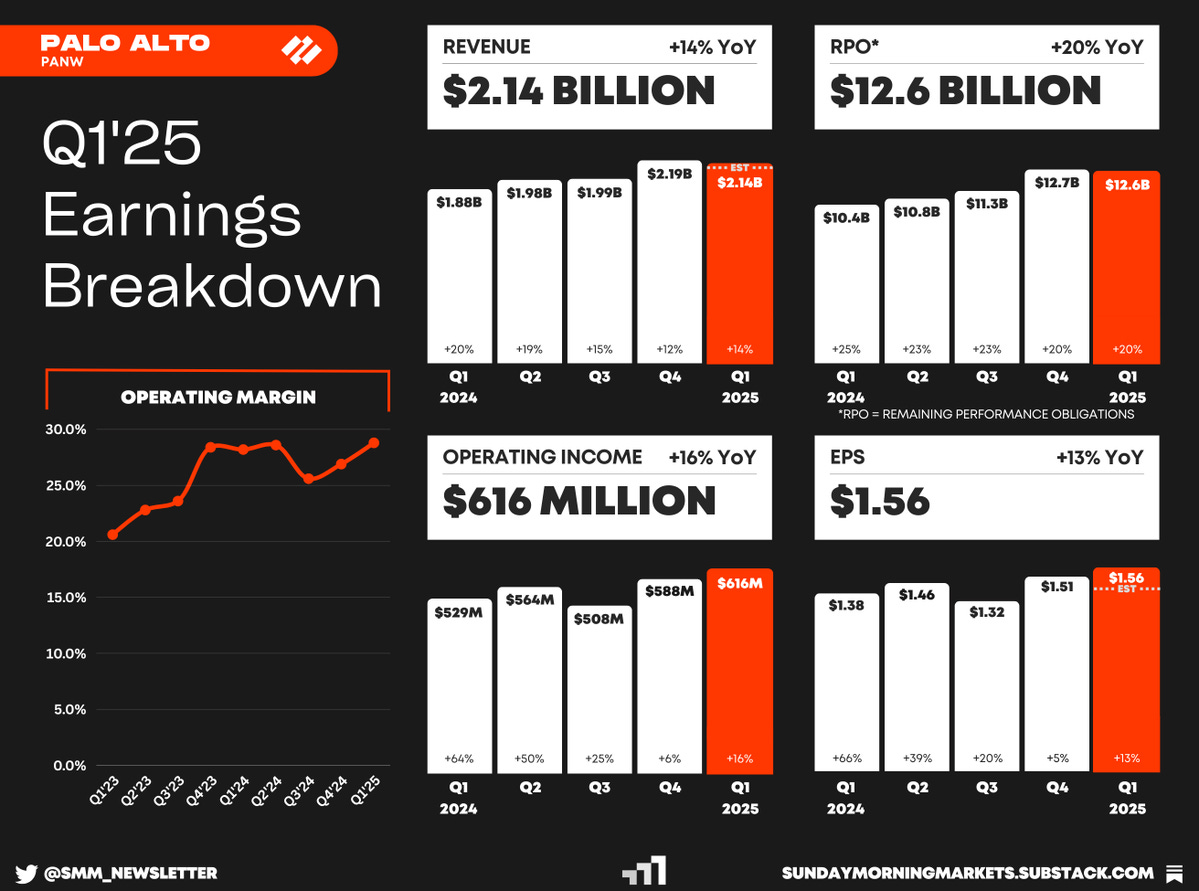

Earnings from Nvidia, Snowflake, and Palo Alto Networks

US Markets 🇺🇸

Gary Gensler to resign as SEC Chair on Jan. 20, clearing the way for Trump to reshape the agency. Gensler's tenure brought bold but controversial crypto and market reforms.

U.S. business activity hits 31-month high as optimism grows for lower interest rates and pro-business policies. The S&P Composite PMI climbed to 55.3, led by services, with inflation easing and new orders surging.

Home sales rose 3.4% in October, the first annual rise in three years. Lower mortgage rates boosted demand with the median selling price hitting $407,200, up 4% year-over-year.

Tesla stock surges as Trump eyes looser self-driving rules. Reports suggest a federal framework for autonomous cars will be a top priority for the new administration, boosting Tesla's regulatory outlook.

Spirit Airlines files for bankruptcy protection, citing mounting losses, a failed JetBlue merger, and surging costs. Operations will continue as it restructures $1.1B in debt.

Comcast to spin off cable networks like CNBC, MSNBC, and E! into a standalone entity. Comcast will retain NBC, Peacock, Bravo, Telemundo, and its sports and theme park businesses.

Global Markets 🌏

Moscow signals readiness for nuclear response after Ukraine strikes Bryansk with U.S. long-range missiles for the first time. Russia responded by updating its nuclear doctrine.

UK inflation surges to 2.3% in October, exceeding forecasts and the Bank of England’s 2% target. The unexpected rise curbs market expectations of a December rate cut.

Japan unveils major $141B stimulus plan to tackle inflation, aid households, and boost innovation. Measures include cash handouts, energy subsidies, and ¥10T for AI and chip tech through 2030.

China maintains benchmark lending rates at 3.1% for 1-year and 3.6% for 5-year following last month's significant cuts. This decision aims to stabilize the yuan amid economic uncertainties.

Canada's inflation climbs back to 2%, dampening expectations for a significant rate cut. Core inflation measures also rose, signaling persistent price pressures ahead of the BoC's Dec. 11 decision.

Billionaire Gautam Adani charged in US bribery case after allegedly paying $265M in bribes to Indian government officials to obtain contracts expected to yield $2B of profit over 20 years.

Xiaomi raises EV delivery target to 130,000 for 2024 amid surging demand, far exceeding its initial 76,000 goal set at the SU7's launch. Q3 revenue soared 31%, though its auto unit remains unprofitable.

Tech ⚡

Amazon to invest another $4B into Anthropic, doubling its stake to $8B. Anthropic will use AWS chips to train models like Claude, with AWS becoming its primary cloud partner.

ServiceTitan files for IPO on Nasdaq under ticker "TTAN" amid renewed investor interest in cloud software. The contractor-focused platform posted $193M in Q3 revenue, up 24% year-over-year.

Super Micro stock soars 37% after hiring new auditor to address compliance issues with Nasdaq. The server maker, boosted by AI demand, pledges to file delayed reports urgently.

Trump Media in talks to acquire crypto platform Bakkt, sending shares soaring over 160%. The move aligns with Trump's growing crypto ventures as he prepares for the White House.

MicroStrategy plans to raise $1.75B via zero-interest notes to buy more Bitcoin as its shares surge 516% this year. The company currently holds 331,200 BTC valued at $32.5B.

French AI startup Mistral debuts Pixtral Large and upgrades its Le Chat chatbot with web search, a canvas tool, and PDF/image analysis. Models now rival GPT-4o and Gemini 1.5.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

DE - Ifo Business Climate 🇩🇪

Earnings: Zoom💰

Tuesday

US - FOMC Meeting Minutes 🇺🇸

US - New Home Sales 🇺🇸

US - CB Consumer Confidence 🇺🇸

NZ - RBNZ Interest Rate Decision 🇦🇺

Earnings: Crowdstrike, Workday, AutoDesk, Analog Devices, Dell💰

Wednesday

US - GDP Growth 🇺🇸

US - PCE Inflation 🇺🇸

US - Pending Home Sales 🇺🇸

US - Durable Goods Orders 🇺🇸

Thursday

US - Markets Closed (Thanksgiving) 🇺🇸

DE - CPI Inflation 🇩🇪

JP - Industrial Production 🇯🇵

Friday

US - Markets Close Early (Thanksgiving) 🇺🇸

CA - GDP Growth 🇨🇦

EU - CPI Inflation 🇪🇺

CN - Manufacturing PMI 🇨🇳

Want to partner with Sunday Morning Markets? Click here to inquire.