What Moved The Markets This Week 📈

Inflation Accelerates In August, Corporate Defaults Hit Decade High, The New iPhone 15, Exodus Of Executives At Binance, Arm Goes Public, and ORCL + ADBE + LEN Earnings

Sunday Morning Markets

Trading Week 37, covering Monday, Sep 11 through Friday, Sept 15. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Inflation Data:

CPI +0.6% YoY vs. 0.6% expected and 0.2% previous

PPI +0.7% MoM vs. 0.4% expected and 0.4% previous

Corporate defaults hit highest monthly count since 2009

Apple reveals iPhone 15, new watch, and updated Airpods

12,700 workers go on strike at Ford, GM, Stellantis

Arm goes public, climbing ~20% in its first trading week

A series of executives stepping down:

Howard Shultz, Chairman of Starbucks

Bernard Looney, CEO of BP

Daniel Zheng, CEO of Alibaba Cloud

Brian Shroder, CEO of Binance.US

Krishna Juvvadi, Head of Legal at Binance.US

Sidney Majalya, Chief Risk Officer at Binance.US

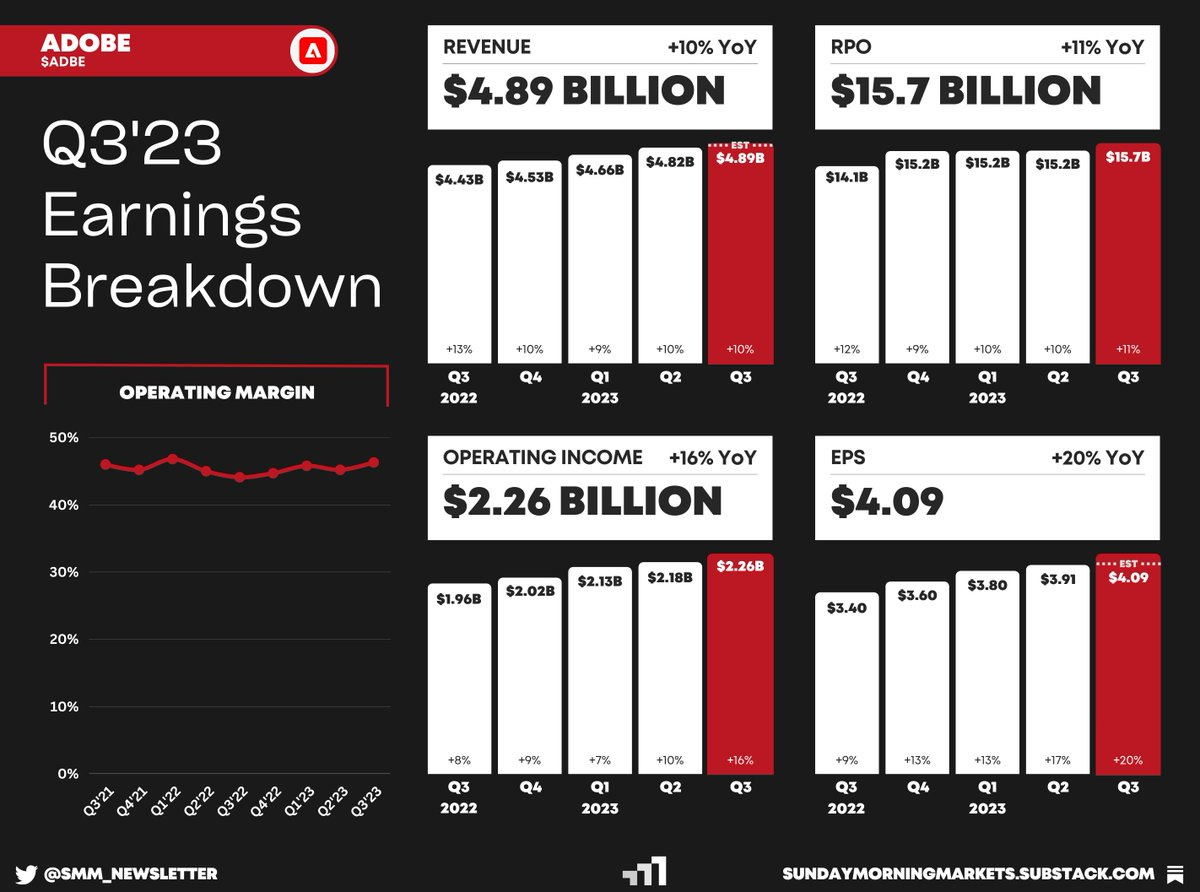

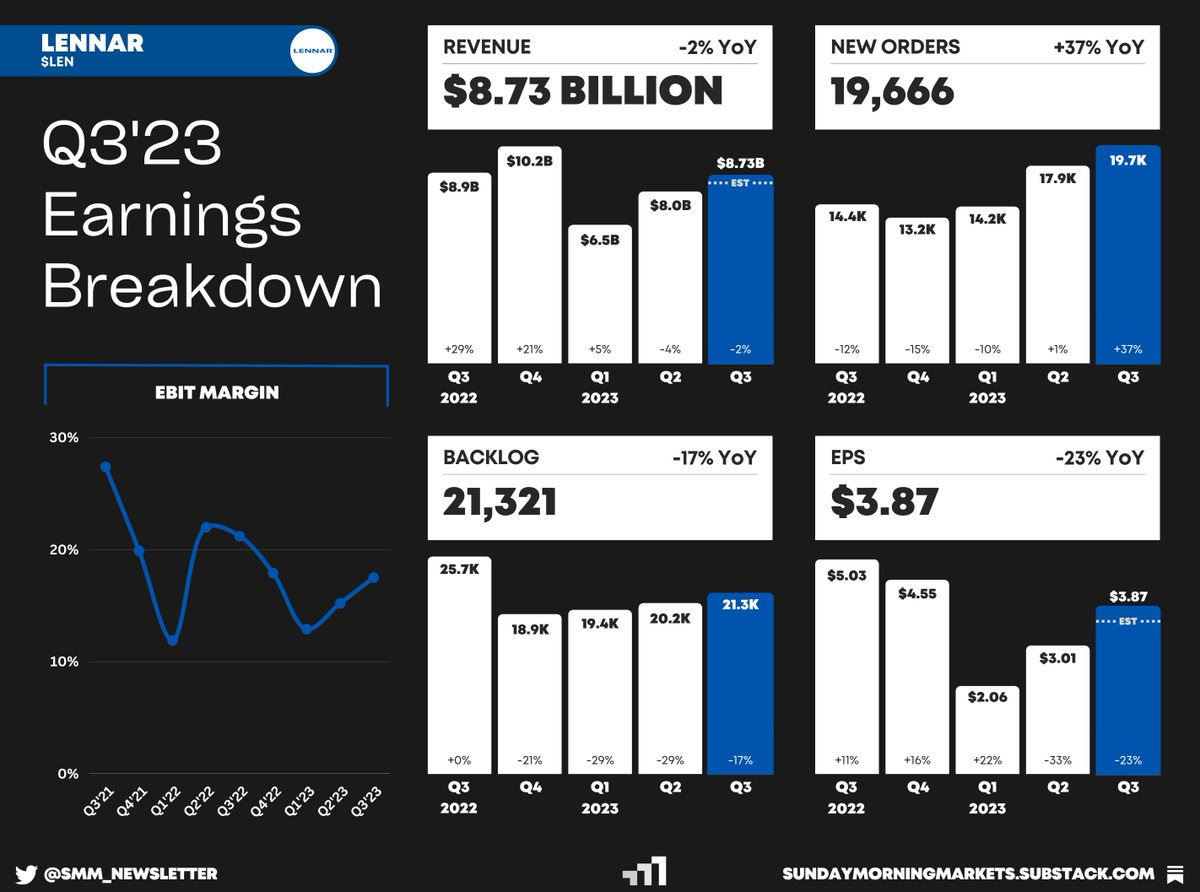

Earnings from Adobe, Oracle, Lennar — see breakdowns below

US Markets 🇺🇸

Inflation accelerated in August as the CPI jumped 0.6%, its largest monthly gain of 2023. Excluding food & energy, Core-CPI increased 0.3% during the month (exp. 0.2%) and 4.3% for the year (exp. 4.3%).

August wholesale inflation surged 0.7%, coming in higher than the 0.4% estimate, and was the largest single-month increase since June 2022. However, excluding food and energy, Core-PPI rose 0.2%, in line with the estimates.

Corporate defaults hit highest level since 2009 as the number of new defaults globally reached 16 in August. S&P’s report showed defaults are well above the previous years’ average of 8.6 in August.

Apple revealed its new iPhone 15 with key features such as longer battery life, USB-C charging ports, and its A17 chip. They also announced a titanium Apple Watch with 72 hours of battery life and updated AirPods with USB-C.

Google makes significant cuts to its recruiting organization as it pulls back on hiring. Google’s VP of recruiting, Brian Org, said “Given the base of hiring that we’ve received the next several quarters, it’s the right thing to do overall.”

Citigroup will reorganize its business said CEO Jane Fraser, with the aim of cutting down management layers and accelerating decisions. The changes will include job cuts, though the company hasn’t decided on a number yet.

ARM climbed 25% in its Nasdaq debut after pricing IPO at $51 a share, raising the company’s market cap to $60B. SoftBank still holds about 90% of Arm’s stock. ARM 0.00%↑ closed the week trading at ~$60 per share.

UAW negotiations stall, 12.7K workers go on strike at three key Ford, GM and Stellantis plants. Key proposals from the union include 40% hourly pay increases, a reduced 32-hour workweek, and a shift back to traditional pensions.

Rest of World 🌏

ECB hikes interest rates another quarter point marking the 10th straight increase as they struggle to rein in inflation. The central bank’s main deposit facility has gone from -0.5% in June 2022 to a record 4% today.

UK economy fares worse than expected in July with strikes in hospitals and schools weighing on output. GDP shrank 0.5% during the month, worse than estimates, as all major sectors of the economy contracted.

China’s retail sales surprise with faster growth in August, jumping 4.6% for the year, coming in well above estimates of 3%. PBOC cut the amount of cash banks need on hand by 25 basis points.

Alibaba Cloud’s CEO, Daniel Zhang, unexpectedly quits just months after announcing he was stepping down from his chairman and CEO roles at the Alibaba Group to focus on the cloud intelligence unit.

Putin meets with North Korea’s Kim Jong Un in Vladivostok. The White House has warned that arms negotiations between the two countries have been “actively advancing” in recent weeks. Russia and North Korea deny those claims.

Tesla plans to double component sourcing from India to $1.9B this year and continue their talks with India’s commerce minister on the possibility of building a gigafactory in India.

Tech ⚡

Binance.US CEO steps down from position which was followed by the departures of the company’s head of legal and chief risk officer. The company also announced it is cutting another 33% of its workforce.

Stability AI launches an AI-powered music generator called ‘Stable Audio’ and claims it is the first model capable of creating “high-quality,” 44.1 kHz music for commercial use via a technique called latent diffusion.

Adobe makes Firefly AI generally and commercially available in its Creative Cloud. Each plan will be given a certain allotment of ‘generative credits’. Once you run out, users will still have access but the features will run significantly slower.

Nvidia and Capital One back Databricks at a $43B valuation in its latest funding round. Databrick’s revenue increased 50% in the quarter that ended in July and is viewed as a top contender for an IPO.

Qualcomm to supply Apple with 5G modems for iPhones through 2026. About 21% of Qualcomm’s fiscal 2022 revenue of $44.2 billion came from Apple, according to a UBS estimate. QCOM 0.00%↑ shares rose 6.6% this week.

OneCoin co-founder sentenced to 20 years in prison on wire fraud and money laundering charges after creating a $4B pyramid scheme. His partner, Ruja Ignatova, remains on the FBI’s Top 10 Most Wanted list.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

CA - Housing Starts (AUG)🇨🇦

Tuesday

US - Building Permits (AUG)🇺🇸

US - Housing Starts (AUG)🇺🇸

CA - CPI Inflation (AUG)🇨🇦

EU - CPI Inflation (AUG)🇪🇺

Earnings Reports: AutoZone💰

Wednesday

US - FOMC Interest Rate🇺🇸

UK - CPI Inflation (AUG)🇬🇧

UK - PPI Inflation (AUG)🇬🇧

DE - CPI Inflation (AUG)🇩🇪

Earnings Reports: FedEx, General Mills💰

Thursday

US - Philly Fed Manufacturing Index (AUG)🇺🇸

US - Existing Home Sales (AUG)🇺🇸

UK - BoE Interest Rate 🇬🇧

CH - SNB Interest Rate 🇨🇭

JP - BoJ Interest Rate 🇯🇵

Earnings Reports: Darden Restaurants, FactSet💰

Friday

US - S&P Services PMI (SEP)🇺🇸

CA - Retail Sales 🇨🇦

UK - Retail Sales 🇬🇧

Want to partner with Sunday Morning Markets? Click here to inquire.