What Moved The Markets This Week 📈

W12 - Fed Hikes Rates Despite Bank Failures, Amazon Cuts 9K Staff, Putin & Xi Meet In Russia, Hindenberg Short Report On Block, Coinbase Receives Wells Notice, and Nike + Chewy Earnings

Sunday Morning Markets

Trading Week 12, covering Monday, Mar 20 through Friday, Mar 24. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Federal Reserve hikes interest rates 25bps

Yellen holds a closed door meeting with top US regulators

Amazon lays off another 9K workers

Existing home sales spike in February

Hindenburg targets Block (SQ) in latest short report

UBS acquires Credit Suisse in $3.25B deal

Presidents Putin & Xi meet in Russia to discuss a new world order

Coinbase comes under pressure from SEC

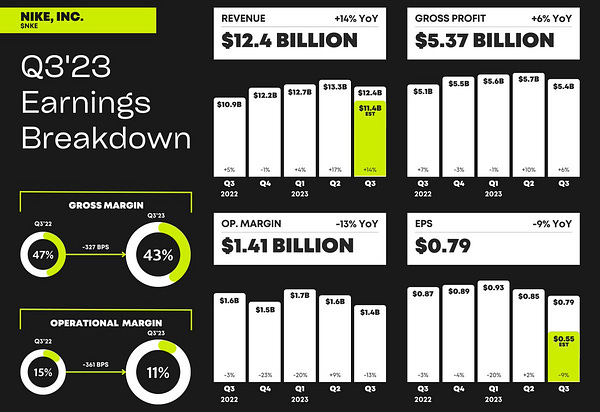

Earnings reports from Nike & Chewy - see breakdowns below

US Markets 🇺🇸

Federal Reserve hikes rates by a quarter point despite ongoing issues in the banking sector. Chair Powell indicated that the banking issues will likely cause tighter credit conditions, and therefore rate increases could be near an end.

Yellen calls top US regulators for an unscheduled meeting that is closed to the public. The meeting comes just two weeks after the SVB collapse as global banking contagion fears continue to spread.

Amazon to lay off another 9K staff members after already reducing its workforce by 18K last year. The latest round is expected to impact AWS, advertising, and Twitch units as demand for its cloud products wanes.

Existing home sales spike in February as the median sales price drops into the negative for the first time in over a decade. Volume was 14.5% higher than the previous month, bringing the annualized rate to 4.58 million units.

TikTok CEO says ByteDance still has access to data on its U.S. users. He noted that its risk mitigation plan “Project Texas” would store all internal user data in the United States, alleviating the risks of data leaking to foreign governments.

Block (SQ) shares plunge 17% after a short report was published by Hindenburg Research, the same firm that targeted Adani Group last month. The report alleges that Cash App facilitates crime and lacks compliance controls.

Rest of World 🌏

UBS acquires Credit Suisse for $3.25 billion in a deal that will make it one of the largest financial institutions globally with more than $5 trillion in total invested assets. CS 0.00%↑ shares have fallen 72% this month.

Xi and Putin pledged to shape a new world order as the Chinese leader leaves Russia with no peace in sight for Ukraine. The White House said China’s position was not impartial and urged Beijing to pressure Russia to withdraw from Ukraine.

UK inflation unexpectedly jumps to 10.4%, breaking its 3-month stretch of declines. On a monthly basis, CPI inflation rose 1.1% (0.6% exp). The Bank of England responded by raising its base rate 25 basis points to 4.25%.

Crypto ⚡

Coinbase receives a Wells notice from the SEC warning the exchange that it identified potential violations of U.S. securities law. Coinbase’s CEO Brian Armstrong responded with a Twitter thread about the issue.

Nasdaq aims to launch crypto custody service by the second quarter of this year. They originally announced intentions to launch the service last September as it looked to respond to the demand from institutional crypto clients.

SMM Product Hunt 🧠

🧑💻 Alpha Vantage provides enterprise-grade financial market data through a set of powerful and developer-friendly APIs. From traditional asset classes (e.g., stocks and ETFs) to economic metrics, from foreign exchange rates to cryptocurrencies, from fundamental data to technical indicators. Alpha Vantage is your one-stop shop for real-time and historical global market data delivered through RESTful stock APIs, Excel, and Google Sheets. Alpha Vantage is highlighted by Hackernoon's survey of major stock market data APIs as well as a recent developer guide on Dev.TO.

Earnings Reports 💰

Week Ahead 📅

Monday

US - Dallas Fed Manufacturing Index (MAR)🇺🇸

Germany - Ifo Business Climate (MAR)🇩🇪

Tuesday

US - CB Consumer Confidence (MAR)🇺🇸

US - Wholesale & Retail Inventories (FEB)🇺🇸

Earnings Reports: BYD, Micron, Lululemon💰

Wednesday

US - Pending Home Sales (FEB)🇺🇸

Eurozone - ECB Meeting🇪🇺

Earnings Reports: Cintas, Paychex💰

Thursday

US - Jobless Claims🇺🇸

Germany - Inflation Rate (MAR)🇩🇪

China - NBS Manufacturing PMI (MAR)🇨🇳

Earnings Reports: Braze, EVgo💰

Friday

US - PCE Inflation (FEB)🇺🇸

US - Personal Income & Spending (FEB)🇺🇸

Canada - GDP (JAN)🇨🇦

Eurozone - Inflation Rate (FEB)🇪🇺

Want to partner with Sunday Morning Markets? Click here to inquire.