What Moved The Markets This Week 📈

W5 - Fed Hikes Interest Rates, Credit Card Debt Hits Record High, Layoffs From PayPal & Rivian, US Payrolls Surge, and Amazon + Apple + Alphabet + Meta Earnings

Sunday Morning Markets

Trading Week 5, covering Monday, Jan 30 through Friday, Feb 3. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Central banks continue tightening; Fed +25 bps, ECB +50 bps, BoE +50 bps

Economic activity slips deeper into contractionary territory with ISM at 47.4

A large slew of layoffs announced by PayPal, Rivian, Workday, Hubspot, and more

Nonfarm payrolls come in significantly hotter than expected at 517K (vs 187K exp)

Google testing search integrations with ChatGPT-like competitors

US credit card debt surges 18.5% during the year to a record $931B

China PMI’s signal growth for the first time in months as the economy reopens

Twitter applies for a payments license with plans to integrate crypto in future

Earnings reports from Apple, Amazon, Alphabet, Meta, UPS, Starbucks, General Motors, and more — see all breakdowns below in the earnings section.

US Markets 🇺🇸

The Fed hikes interest rates 25 basis points and foreshadows it may only have a few left before an eventual pause. Chairman Powell had a slightly dovish tone in the press conference and noted ‘disinflation’ has started.

Payrolls spiked 517K last month, well above estimates of 187K as the unemployment rate sank to a 55-year low at 3.4%. Average hourly earnings rose 0.3% during the month and 4.4% during the year, in line with expectations.

Layoffs in tech continue to pile up as PayPal, Rivian, Workday, Upstart, Okta, Hubspot, DraftKings, Splunk, and others make cuts this week. According to layoffs.fyi, 288 tech companies have laid off 88K workers so far in 2023.

U.S. manufacturing sector sinks further as ISM reports a Manufacturing PMI of 47.4 (48.0 exp.) for January, down from 48.4 the month prior. Prices paid jumped to 44.5, signaling prices continue to slide but at a slower pace.

Google is testing ChatGPT-like competitors as it looks to integrate the feature into a new search page design. ChatGPT’s explosive launch has lit a fire under Google, as more employees have been asked to help test the efforts internally.

Meta increased its stock buyback program by $40B after taking steps to improve capital efficiency by reducing employee headcount and cutting CAPEX forecasts for FY'23. META 0.00%↑ shares jumped over 25% this week.

U.S. credit card debt surges 18.5% during the year and hits a record $930.6 billion as consumers continue to digest higher inflation and higher interest rates. The average balance rose to $5,805 over that same period.

Rest of World 🌏

Bank of England hikes rates by 50 basis points, taking the bank rate to 4%. They also indicated in their decision statement that smaller increases and an eventual end to the hiking cycle may be in the cards in coming meetings.

European Central Bank lifts rates by 50 basis points, taking its key rate to 2.5%. In a hawkish tone, the central bank said they intend to hike by another 50 basis points at their March meeting.

Eurozone inflation dips for a third straight month as energy prices continue to fall. Headline inflation came in at 8.5% in January, below the consensus forecast of 9.0%, and down from 9.2% in December.

China’s January factory activity returns to growth as economists cheer its reopening. China’s official PMI rose to 50.1, above consensus estimates of 49.8, and up significantly from last month’s reading of 47.0.

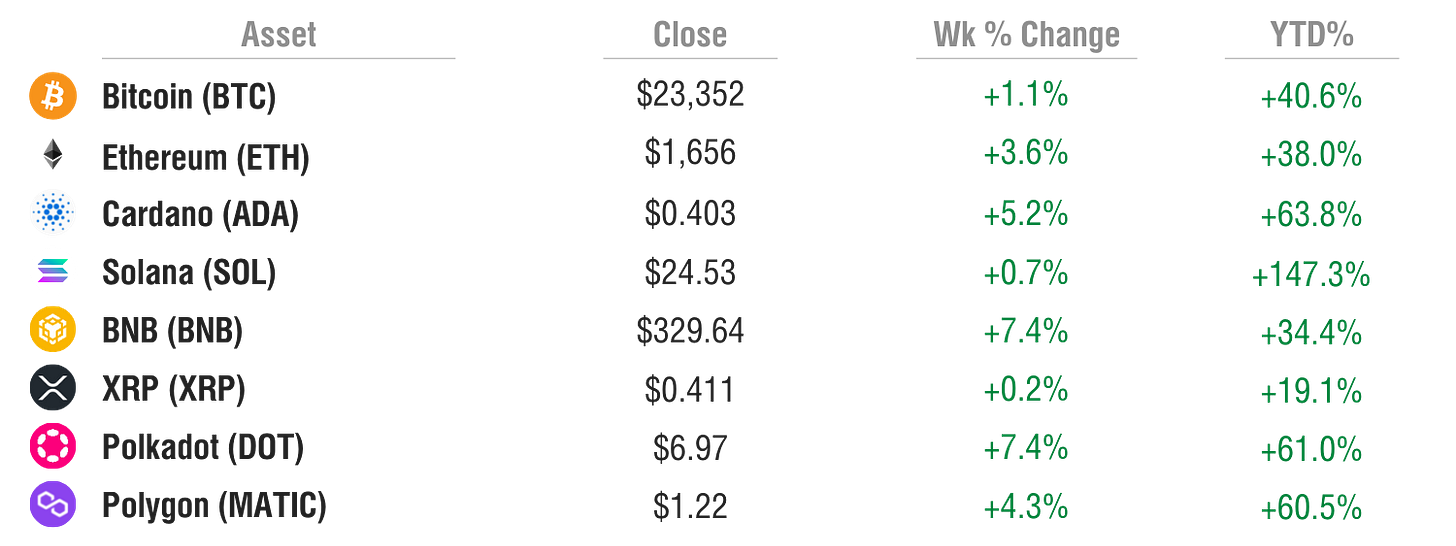

Crypto ⚡

Celsius used new customer funds to pay for withdrawals, the typical definition of a Ponzi scheme, an independent examiner for the U.S. bankruptcy court said.

Celsius allows specific users to withdraw assets at 94 cents on the dollar if they can cover the withdrawal fees. The customers eligible for withdrawals should receive an email on Feb 15 with further steps on how to process transfers.

BonqDAO protocol suffers a $120M loss after an oracle hack allowed the exploiter to manipulate the price of the AllianceBlock token. The hacker stole $108m in BEUR tokens and $11m in wrapped-ALBT tokens.

SMM Product Hunt 🧠

Dilutional.com is a promising new tool that can help you be more successful in the stock market. Their algorithm and the data that they provide takes a lot of the complexity out of trading.

The features they offer include access to market data, live charts, pattern and trend recognition, instant alerts, direct access to press releases, and stock price predictions.

The stock prediction tool uses different algorithms to predict a stock’s downfall, giving you advance warning to help prevent losses or provide opportunities to short with a higher conviction.Trading in US markets can be extremely complex, but incorporating this tool into your strategy could greatly increase your chances of success and save time in the process.

The product is currently in private beta, but expected to launch this year. The pricing and exact launch date have yet to be revealed, but you can join their waitlist today to be eligible for a free trial and get notified of when they launch.

Earnings Reports 💰

Follow our Twitter account for real-time breakdowns of earnings reports.

Apple ($AAPL) - Report

Revenue: $117.2B vs $121.9B expected and $123.9B year ago (-5% YoY)

EPS: $1.88 vs $1.94 expected and $2.10 year ago (-10% YoY)

Segment Breakdown:

iPhone: $65.8B (+8% YoY)

Mac: $7.7B (-29% YoY)

iPad: $9.4B (+30% YoY)

Wearables: $13.5B (-8% YoY)

Services: $20.8B (+6% YoY)

Guidance: None given.

Market Reaction: +2.4%

—

Amazon ($AMZN) - Report

Revenue: $149.2B vs $145.6B expected and $137.4B year ago (+9% YoY)

EPS: $0.03 vs $0.17 expected and $1.39 year ago (-98% YoY)

Segment Breakdown:

North America: $93.4B (+13% YoY)

International: $34.5B (-8% YoY)

AWS: $21.4B (+20% YoY)

Guidance: Q1 sales of $121.0B - $126.0B ($116B year ago) with operating income in the range of $0 and $4.0B ($3.7B year ago)

Market Reaction: -8.4%

—

Alphabet ($GOOG) - Report

Revenue: $76.0B vs $76.1B expected and $75.3B year ago (+1% YoY)

EPS: $1.05 vs $1.15 expected and $1.53 year ago (-32% YoY)

Segment Breakdown:

Google Services & Ads: $67.8B (-2% YoY)

Google Cloud: $7.3B (+32% YoY)

Other Bets: $0.2B (+25% YoY)

Guidance: None given.

Market Reaction: -3.3%

—

Meta ($META) - Report

Revenue: $32.17B vs $31.53B expected and $33.67B year ago (-4% YoY)

EPS: $1.76B vs $2.26 expected and $3.67 year ago (-52% YoY)

Metrics:

Daily Active People: 2.96B, up 5% YoY

Monthly Active People: 3.74B, up 4% YoY

Average Revenue Per Person: $8.63, down 8% YoY

Guidance: Increased share repurchase agreement by $40B. Reduced their OPEX and CAPEX guidance for FY23. Projected revenue in Q1 at $26-28.5B.

Market Reaction: +23.3%

—

Other Reports

Week Ahead 📅

Monday

Canada - Ivey PMI (JAN) 🇨🇦

Eurozone - Retail Sales (DEC) 🇪🇺

Australia - RBA Interest Rate Decision 🇦🇺

Earnings Reports: Activision, Pinterest, ZoomInfo💰

Tuesday

India - Interest Rate Decision 🇮🇳

Earnings Reports: SoftBank, Chipotle, Enphase, Fortinet, Paycom💰

Wednesday

Earnings Reports: Disney, Uber, CVS, Robinhood, Affirm💰

Thursday

Germany - CPI Inflation (JAN) 🇩🇪

China - CPI Inflation (JAN) 🇨🇳

China - PPI Inflation (JAN) 🇨🇳

Earnings Reports: PayPal, Cloudflare, Lyft, AbbVie, Pepsi, Toyota, Hilton, Expedia Group💰

Friday

US - UMich Consumer Sentiment (FEB) 🇺🇸

Canada - Unemployment Rate (JAN) 🇨🇦

UK - GDP (Q4) 🇬🇧

Did you like this Sunday Market Newsletter? Consider sharing it!

We’d love to hear your thoughts about SMM. Click here to give feedback.

Want to partner with Sunday Morning Markets? Click here to inquire.