Weekly Financial Market Insights 📈

Trading Week 44 ... Fed Hikes Interest Rates Again, Another Surge In Tech Layoffs, Japan's Struggles To Control Yen, Instagram Launches NFTs, and Uber + DoorDash + Airbnb + PayPal Earnings

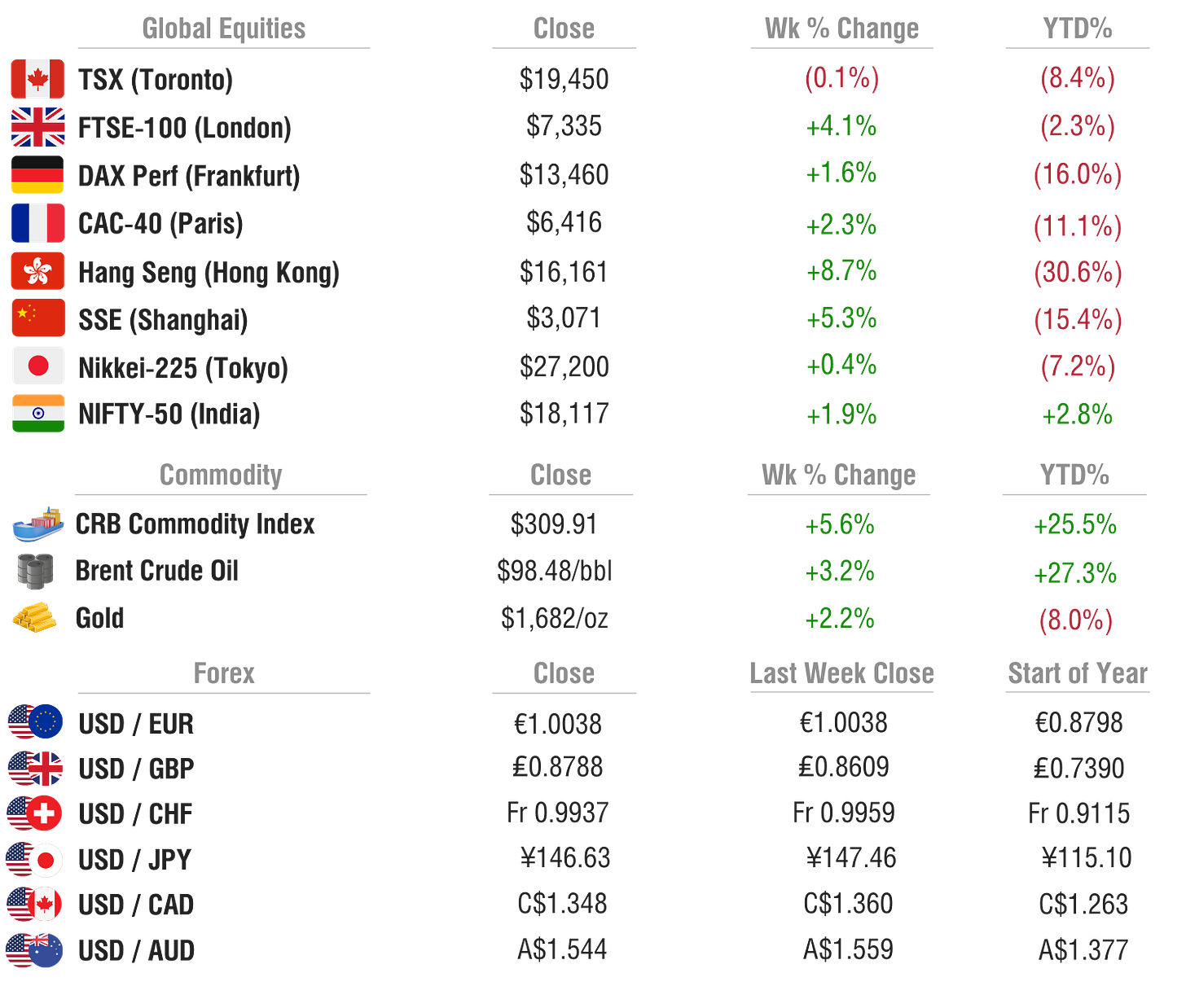

Sunday Morning Markets ☕

Your weekly financial markets update, in less than 5 minutes. Covering Monday, Oct 31 through Friday, Nov 4.

The Week In Review ⏪

The U.S. Federal Reserve & Bank of England both hiked their core interest rates by 75 bps as central banks across the globe scramble to fight inflation.

Layoffs in the tech ecosystem continue. Twitter, Stripe, Lyft, Opendoor, Pleo, Dapper Labs, and Smava all announced large layoffs this week.

The U.S. labor market remains tight as nonfarm payrolls and job openings surge.

FCC Commissioner suggests a U.S. ban on TikTok.

Instagram launching NFT platform for creators.

US Markets 🇺🇸

Federal Reserve hikes interest rates by 75 bps to a target range of 3.75% - 4%. The release had a dovish feel as it noted that they would take into account the “cumulative tightening” and “lags of monetary policy” in future FOMC decisions. However, Chairman Powell crushed that dovish takeaway as he said the hopes of a pivot were “very premature”.

Twitter, Stripe, Lyft, and Opendoor all announce layoffs as markets continue to put pressure on companies to reduce operational expenses and focus on profitability. Twitter cuts its headcount by 50%, Stripe by 14%, Lyft by 13%, and Opendoor by 18%. Meanwhile, Apple and Amazon announce hiring freezes.

Nonfarm payrolls grew by 261K in October, exceeding expectations of 205K as hiring remains strong. The unemployment rate moved higher to 3.7% while the average hourly earnings rose 0.4% for the month, and 4.7% for the year.

Job openings surge to 10.7m in September coming in well above estimates of 9.85m despite the Federal Reserve's efforts to loosen up the historically tight labor market. The data indicates that there are 1.9 job openings for every available worker.

FCC commissioner says U.S. should ban TikTok causing shares of Meta and Snapchat to surge. The comments do not necessarily signal any pending actions against TikTok, but Commissioner Carr noted “I don’t believe there is a path forward for anything other than a ban.”

Rest of World 🌏

Bank of England raises rates 75 bps marking its eighth consecutive hike and its largest in over three decades. The central bank also noted that "further increases in Bank Rate may be required for a sustainable return of inflation to target”.

US and UAE sign $100B clean energy partnership in a bid to reduce dependency on oil. The bill, named PACE, aims to mobilize $100 billion in investment, financing, and other support to produce 100 gigawatts of clean energy by 2035.

Japan spent a record $42.8B in their interventions to prop up the Yen from its epic collapse. The Yen hit a 32-year low of 151.94 on October 21st before the central bank stepped in to sell USD and buy JPY.

Eurozone inflation hits a record high of 10.7% led by a 42% increase in energy prices. In Italy, headline inflation came in above expectations at 12.8% for the year while Germany and France reported inflation at 11.6% and 7.1%, respectively.

European PMIs hit a multi-year low as growth has slowed significantly from the year prior. The Eurozone Composite PMI fell to 47.3, down from 48.1 last month. The drop was led by Germany, which reported a composite PMI of 45.1.

Crypto ⚡

Instagram users will be able to mint and sell NFTs as the social media platform tests its new digital collectibles feature with a handful of creators. The product will initially launch on the Polygon in the next couple of weeks.

Coinbase revenue plunges 50% from the year prior as crypto falls out of favor with many investors. The exchange had a Q3 trading volume of $159B, a 51% drop vs a year ago. "For 2023, we’re preparing with a conservative bias and assuming that the current macroeconomic headwinds will persist”.

Twitter pauses work on its crypto wallet as Elon continues to look for ways to cut operational expenses. "A recently revealed plan to build a crypto wallet for Twitter appears to be on pause”.

SMM is powered by

🧑💻 Alpha Vantage provides enterprise-grade financial market data through a set of powerful and developer-friendly APIs. From traditional asset classes (e.g., stocks and ETFs) to economic metrics, from foreign exchange rates to cryptocurrencies, from fundamental data to technical indicators, Alpha Vantage is your one-stop shop for real-time and historical global market data delivered through RESTful stock APIs, Excel, and Google Sheets.

Earnings Reports 💰

Uber Technologies ($UBER) — View report

Revenue: $8.34B vs $8.12B expected and $4.85B year ago (+72% YoY)

EPS: ($0.61) vs ($0.17 expected) and ($1.28) year ago (+52% YoY)

Adj EBITDA: $516m vs $8m year ago (+6,350% YoY)

Segment Breakdown:

Mobility: $3.8B ( +73% YoY)

Delivery: $2.8B (+24% YoY)

Freight: $1.8B (+336% YoY)

Guidance for Q4: Gross bookings of $30B - $31B. Adj EBITDA of $600m - $630m.

Market Reaction (24hrs after report): +11.9%

—

Airbnb ($ABNB) — View report

Revenue: $2.88B vs $2.85B expected and $2.24B year ago (+29% YoY)

EPS: $1.79 vs $1.55 expected and $1.22 year ago (+47% YoY)

Nights & Expierences Booked: 99.7m vs 79.7m year ago (+25% YoY)

Gross Booking Value: $15.6B vs $11.9B year ago (+31% YoY)

Guidance for Q4: Revenue of $1.8B - $1.88B

Market Reaction (24hrs after report): -13.4%

—

AMD ($AMD) — View report

Revenue: $5.6B vs $5.7B expected and $4.3B year ago (+29% YoY)

Non-GAAP EPS: $0.67 vs $0.80 expected and $0.73 year ago (-8% YoY)

Free Cash Flow: $842m vs $764m year ago (+10% YoY)

Segment Breakdown:

Data Centers: $1.6B, +45% YoY

Client: $1.0B, -40% YoY

Gaming: $1.6B, +14% YoY

Embedded: $1.3B, +1549% YoY

Guidance for Q4: Revenue of $5.2B - $5.8B

Market Reaction (24hrs after report): -1.7%

—

Paypal ($PYPL) — View report

Revenue: $6.85B vs $6.82B expected and $6.18B year ago (+11% YoY)

EPS: $1.08 vs $0.96 expected and $1.11 year ago (-3% YoY)

Total Payment Volume: $337B vs $310B year ago (+9% YoY)

Free Cash Flow: $1.77B vs $1.29B year ago (+37% YoY)

Guidance for Q4: Sales of $7.4B. Non-GAAP EPS of $1.18 - $1.20

Market Reaction (24hrs after report): -1.8%

—

DoorDash ($DASH) — View report

Revenue: $1.7B vs $1.63B expected and $1.28B year ago (+33% YoY)

EPS: ($0.77) vs ($0.55) expected and ($0.30) year ago (-157% YoY)

Gross Order Volume: $13.53B vs $10.42B year ago (+30% YoY)

Marketplace Orders: 439m vs 347m year ago (+27% YoY)

Market Reaction (24hrs after report): +8.3%

—

Other Reports:

Week Ahead 📅

Monday

Germany - Industrial Production (Sep) 🇩🇪

Australia - NAB Business Confidence (Oct) 🇦🇺

Earnings Reports: Activision Blizzard ($ATVI), Palantir ($PLTR) 💰

Tuesday

Europe - Retail Sales (Sep) 🇪🇺

China - CPI Inflation (Oct) 🇨🇳

Earnings Reports: Disney ($DIS), Lucid ($LCID), NIO ($NIO), Affirm ($AFRM), Upstart ($UPST) 💰

Wednesday

Mexico - CPI Inflation (Oct) 🇲🇽

UK - RICS House Price Balance (Oct) 🇬🇧

Earnings Reports: Rivian ($RIVN), Roblox ($RBLX), TradeDesk ($TTD), Unity ($U) Coupang ($CPNG) 💰

Thursday

US - CPI Inflation (Oct) 🇺🇸

Brazil - CPI Inflation (Oct) 🇧🇷

Mexico - Interest Rate Decision 🇲🇽

Earnings Reports: Astrazeneca ($AZN), Toast ($TOST), Wix.com ($WIX), WeWork ($WE) 💰

Friday

US - Consumer Confidence (Nov) 🇺🇸

UK - GDP (Q3) 🇬🇧

UK - Industrial Production (Sep) 🇬🇧

Germany - CPI Inflation (Oct) 🇩🇪

Did you like this Sunday Market Newsletter? Consider sharing it!

We’d love to hear your thoughts about SMM. Click here to give feedback.